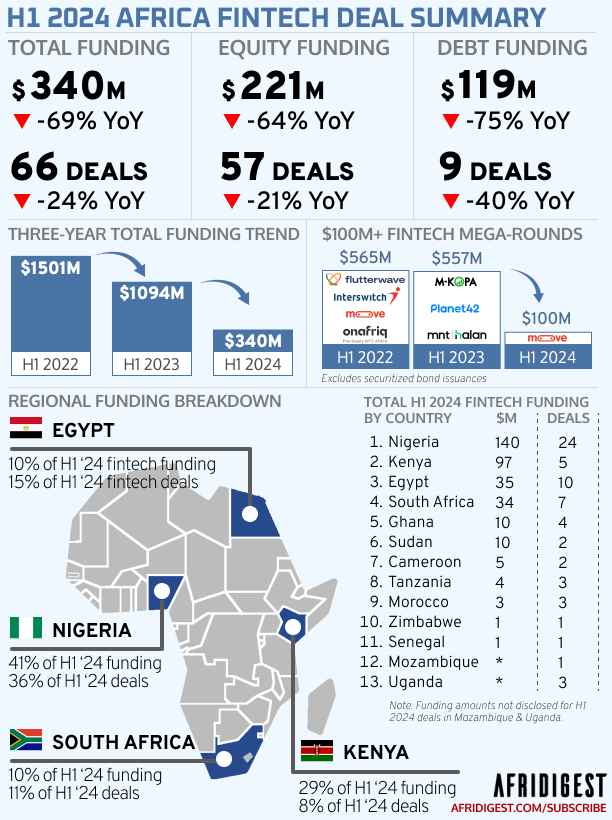

In H1 2024, roughly 60 fintech startups across Africa announced raising $340M in risk capital (equity and debt) over 66 transactions.

Total fintech funding raised across the continent in the first half of 2024 was down ~70% compared to the same period last year. But the number of deals announced held firmer, declining only 24% compared to H1 2023.

Here’s a quick summary of fintech funding across Africa in the first half of the year:

Key trends to watch:

- Market bottom? African fintechs raised ~$340M in H1 2024, down from ~$1.1B in H1 2023 and $1.5B in H1 2022. It feels like we’re closer to the end of the downturn than the beginning. We’d wager that H1 2025’s total funding figure will be greater than $340M.

- New normal? The average fintech deal size on the continent fell from $13M a year ago to $5M so far this year. This seems like right-sizing as efficiency and bang-per-buck is more top of mind for entrepreneurs and investors.

- Rare mega-rounds. After years of multiple fintech mega-rounds in H1, only Nigeria’s Moove raised over $100M in H1 2024. There are probably a few more fintech mega-rounds to come over the next 12 months or so across the continent. Likely among them: the expected unicorn round of South Africa’s TymeBank.

- NEKS dominance. Nigeria, Egypt, Kenya, and South Africa (NEKS) accounted for 90% of fintech funding. But they only accounted for 70% of deals. While investors increasingly explore beyond these core markets, they’re core for a reason — and they dominate big-ticket deals.

- Beyond the Big Four. Ghana, Senegal, Cameroon, Tanzania, Morocco, and Uganda are the emerging fintech markets to watch. Ghana and Senegal are already well recognized in fintech circles across the continent, but interesting developments are underway in the MUCT/‘Little Four’ countries: Morocco, Uganda, Cameroon, and Tanzania.

Early-stage Africa-focused tech startups: Apply today to be featured in the Afridigest Startup Spotlight.

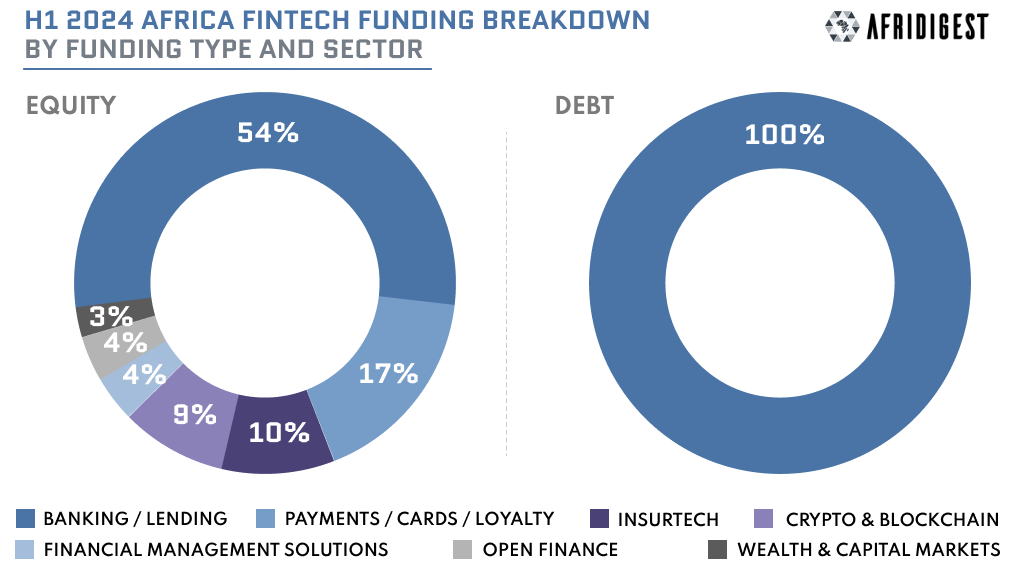

In terms of verticals, Banking/Lending led the way, accounting for $0.54 of every dollar of equity raised and all debt raised in 2023.

Not surprisingly, payments was second as it’s been in years past. But in a new development insurtech claimed the #3 spot.

Be smart: In H1 2024, the Banking/Lending vertical was driven by asset financing platforms like Moove, M-KOPA, Planet42, Watu, and Mogo Kenya.

Share: